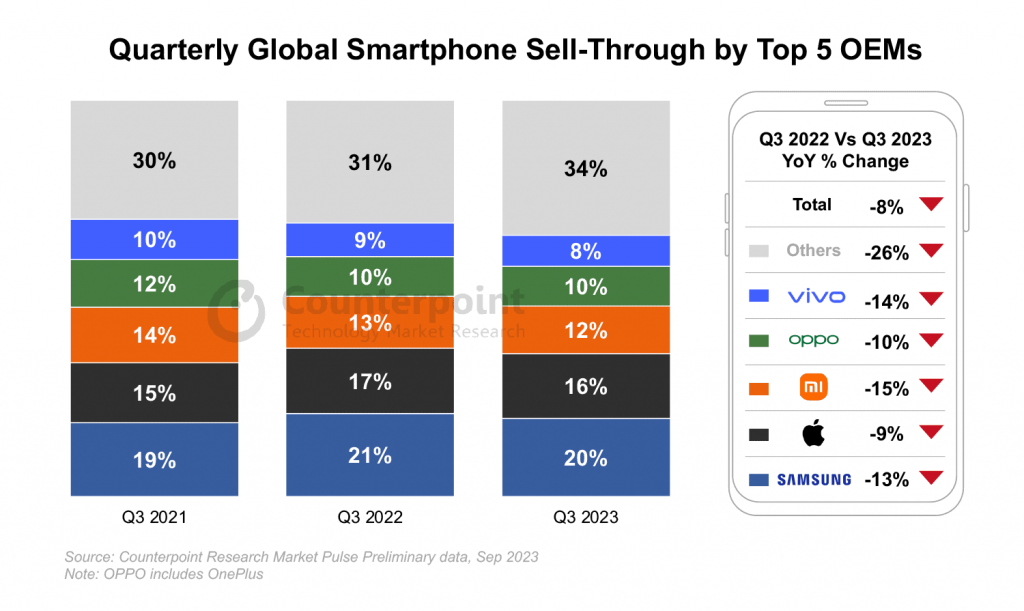

Global smartphone sales took an 8% dip in Q3 2023 when compared to the same period in the previous year, marking the ninth consecutive quarter of decline. Nevertheless, there was a glimmer of hope with a 2% growth compared to the previous quarter, as revealed by research from Counterpoint‘s Market Pulse service.

The slump in sales, compared to last year, was primarily a result of sluggish consumer demand recovery. However, the surge in sales throughout the quarter, particularly in September, despite a shorter sales window for new iPhones, suggests better days lie ahead.

Global Smartphone Sales Trends

In the global smartphone sales race for Q3 2023, the top five OEMs made their moves:

1. Samsung – Unsurprisingly, Samsung emerged as the leader in the global market, contributing a fifth of the sales for the quarter. The reception of their new foldable phones was a mixed bag, with the Flip 5 outselling its counterpart by nearly two-fold. The A-series models from Samsung dominated the mid-price segments.

2. Apple – Apple secured the second spot, with a 16% market share, despite limited availability of the iPhone 15, which was well-received.

Gizchina News of the week

3. Xiaomi, OPPO, and vivo – These three companies rounded out the top five, though they experienced year-over-year declines. They directed their efforts towards solidifying their positions in the vast markets of China and India while retreating from overseas expansion.

4. HONOR, Huawei, and Transsion Group – These brands managed to gain market share and achieve year-over-year growth in Q3. Huawei’s growth was largely driven by the Mate 60 series in China, while HONOR’s success came from strong overseas performance.

5. Transsion Brands – The Transsion brands expanded, benefiting from the Middle East and Africa (MEA) market’s recovery.

Positive Signs in MEA Region

The Middle East and Africa (MEA) region emerged as the only area with year-over-year growth in Q3, thanks to improving macroeconomic indicators. In stark contrast, developed markets like North America, Western Europe, and South Korea faced significant declines. However, these developed markets are expected to bounce back in Q4, largely due to the delayed iPhone launch.

Market Expectations for Q4 2023

Counterpoint predicts that the momentum will continue through year-end. Factors contributing to this positive outlook include the full impact of the iPhone 15 series, the festive season in India, the 11.11 sales event in China, and end-of-year promotions. They foresee a halt in year-over-year declines in Q4 2023.

However, Counterpoint also foresees an overall market decline for the entire year of 2023. Possibly reaching its lowest point in a decade. This transformation is attributed to changing device replacement patterns, particularly in developed markets.

Counterpoint highlights the recovery of emerging markets and the growth of brands outside the top five as indicators of shifting dynamics and opportunities in the global smartphone market.

Conclusion

In conclusion, the smartphone market has experienced a rocky road in Q3 2023. With a drop in sales compared to the previous year, making it the ninth consecutive quarter of decline. However, the slight growth in the quarter, especially in September, provides a glimmer of optimism. The battle for dominance among top OEMs continues, with Samsung and Apple leading the charge. Counterpoint anticipates a positive Q4 driven by various factors, although the year as a whole may witness a decline. Signaling changing consumer patterns in developed markets. Despite the challenges, the recovery of emerging markets and the rise of alternative brands reflect the evolving landscape of the global smartphone industry.

Via: gizchina.com